Surge In Properties For Sale

Much of the media focus this week centred on rising stock levels and what effect this may have on property prices.

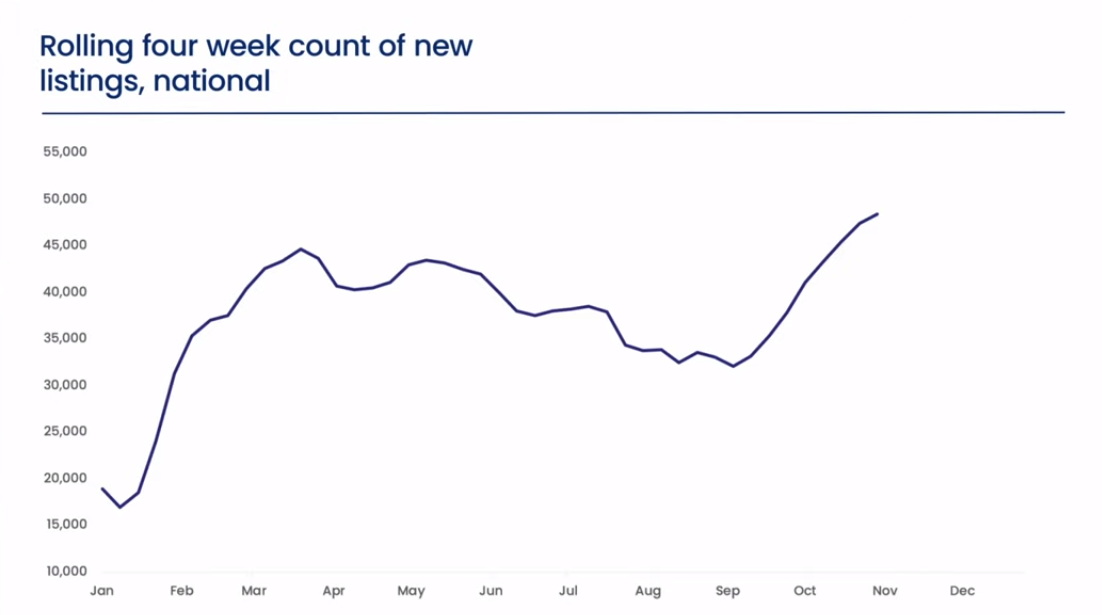

One such example was an article written by Anne Flaherty from Proptrak that featured on realestate.com.au this week showing how the number of new listings is now rising sharply.

As shown and discussed in the article that is the feature story in this week's report, new house listings coming to market were up by almost 10% in Queensland & 20% Nationally to start November when compared to the same time last.

The article goes on to explain why this is good news for buyers by referencing the simple formula of supply v demand. Throughout 2021 we have seen historically low stock levels which has aided the incredible upward pressure on prices. With listing numbers increasing, buyer affordability becoming a concern and interest rates likely to rise faster than predicted, many economists believe that the property market will start to level out as we approach 2022.

Please see below the article that appeared on REA this week.

Surge in properties for sale is good news for buyers

In good news for those looking to buy over the coming months, the number of properties hitting the market is beginning to rise.

Demand to buy property has considerably outweighed the supply of dwellings for sale over the past 18 months, compounding the effect of low interest rates on price growth.

But now that restrictions are easing and borders are reopening, supply is making a comeback.

A pent-up stock of properties which, in the absence of lockdowns, would have been brought to market earlier in the year, are now coming up for sale.

Further boosting supply, the preference for selling before the holiday season kicks in means November looks set to be a bumper month.

In no city is this more evident than Greater Melbourne, where the total number of homes listed for sale jumped by 75% between August and September, and a further 35% in October.

Greater Melbourne has since played host to six consecutive weeks of 1,000-plus auctions, with 3,000 more currently scheduled over the coming fortnight.

For context, scheduled auctions were hovering around the 300-mark during the height of lockdown.

And it’s not just Melbourne.

This is good news for buyers. More properties for sale results in more choice for buyers – and may help to alleviate the intensity of competition in the market.

When a higher number of buyers are competing for a smaller pool of properties, these properties typically generate more views and sell faster. In October, the average Australian property was selling three weeks faster compared to the 12 months prior.

Increased competition also impacts prices, driving many buyers to up their offers to ensure a successful bid.

So, with supply now increasing, are we moving from a seller’s market to a buyer’s market? Not yet.

While this increased supply should help to relieve some of the pressure in the market, buyer demand remains at close to record levels.

Please see below a graph from corelogic showing the trend in new listings nationally over the last 12 months.