Fundamentals Driving Today's Market.

With the month of February now complete, we once again have an enormous amount of articles and statistical information that gives us an insight into current market conditions.

We have chosen two lead articles this week and both discuss key fundamentals driving today's market.

Whilst these articles provide value, it may very well be our own numbers that best reflect current market sentiment.

When we look at our February open homes over the past few years, the stand out metric for 2024 is simply the volume of buyers currently in the marketplace.

Its interesting to note that our average number of attendees in 2024 is now higher than at any stage throughout the 2020's

Even when taking into account the extremely strong markets of early 2021 & 2022, the interest currently in the property market is at record levels.

Will these numbers continue ? Only time will tell but as you will see below, it is clearly a sellers market right now.

Our February open home numbers from 2020 - 2024 are below

Year OFI's Attendees Avg Attendees Per Open Home

2020 192 786 4.1

2021 82 682 8.3

2022 154 1541 10.0

2023 211 1359 6.4

2024 133 1372 10.3

These numbers should give potential sellers the confidence needed to know that now is an incredible time to sell, particularly with stock levels still yet to pick up as predicted.

Amongst our articles today are the HTW Valuers report for the completed month of February.

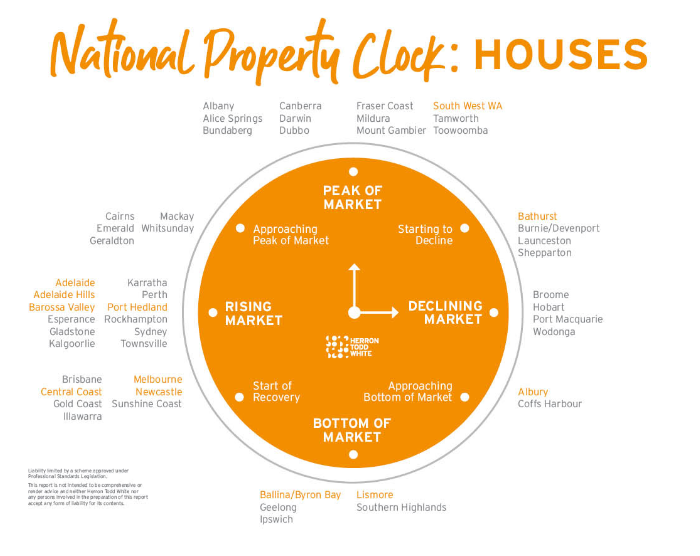

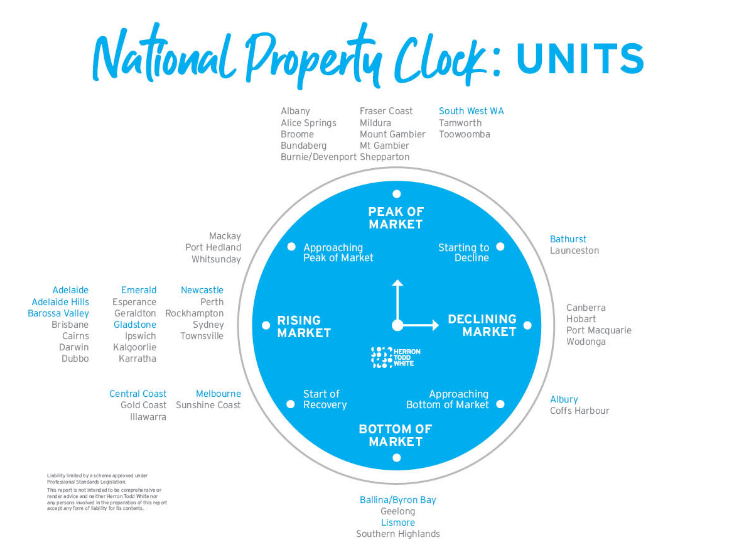

Again, the HTW property clock shows the Gold Coast as currently being in the " Start of Recovery" phase.

We have also added a research piece released this week by Brooke Cooper of Savings.com.au that focuses on where people are choosing to relocate, with the Sunshine Coast and Gold Coast leading the way based on statistics from late 2023.

This is our first article this week. Please see below

City-dwellers flock to regional Queensland, where house prices are soaring

Queensland appears to have attracted Aussies from all over in recent times, with the Sunshine Coast and the Gold Coast having been crowned the nation’s two most popular regional relocation destinations.

Nearly one in five people moving to regional Australia in the December quarter landed in the Sunshine Coast, where they appear to have driven property prices higher.

Meanwhile, around one in 12 unpacked their bags in the Gold Coast, where the median house value has officially pushed past the coveted $1 million mark.

That’s according to data from the Real Estate Institute of Queensland (REIQ) and the Regional Movers Index, the latter being a partnership between CommBank and the Regional Australia Institute (RAI).

Many of those who leave behind capital cities in exchange for regional living do so in a bid to gain more space, time, and affordability, RAI CEO Liz Ritchie said.

But inbound migration also offers notable benefits for the Sunshine State.

“A skilled and diverse labour supply is one of the most critical inputs for any economy and Sunshine Coast businesses across a wide range of sectors are taking advantage of the growth in people coming to the area, moving at pace to explore new and innovative opportunities,” said Paul Fowler, CommBank executive general manager of regional and agribusiness banking.

Sunshine Coast house prices climbed nearly 2.7% over the three months ending December, with the median sale price reaching $980,000 in that time, REIQ revealed today as per CoreLogic data.

Gold Coast house prices rose 5% in the same window, with more than 1,800 sales bringing in a median $1.05 million.

However, Gold Coast’s popularity as a migratory destination has waned in recent times, with the number of people moving there having halved year-on-year.

“While these sale prices are cause for celebration for property owners when it comes time to sell, it can be frustrating and disheartening for buyers trying to enter or transition into the market,” REIQ CEO Antonia Mercorella said.

“This is particularly true for first home buyers who are competing with other prospective and established buyers for value buys and deals that aren’t as good as they once were.”

Ms Mercorella notes that in “lifestyle locations”, such as the Gold Coast, the majority of housing stock hitting the market intends to cater to luxury living.

“There’s been low levels of construction over a long period of time, lagging social housing builds, and add to that accelerated migration to Queensland, and you’ve got a recipe for a housing crisis.”

She's calling for an increase in supply, saying building more affordable dwellings would help to balance the state’s housing market.

“We’re still in a position where the shortage of supply is driving the market and we’re lacking the housing diversity we need for everyone in our community, the critical gap of course is at the affordable end of the market,” she said.

“For listings that address this gap, real estate agents are reporting that the open homes are overflowing, and second open homes are often unnecessary”

But not all of Queensland’s oft-considered ‘luxury’ housing markets are booming at the moment.

Slightly further north of the Sunshine Coast, Noosa house prices tumbled 9.4% last quarter to a median sale price of $1.25 million.

Property in Noosa also spent an average of 52 days on the market – the longest of any Queensland region.

Key points

The Sunshine Coast and the Gold Coast have been crowned the nation's most popular regions to move to

Both have also seen property prices surge, rising 2.7% and 5% respectively over the three months ended December

REIQ CEO Antonia Mercorella said rising house prices can be 'frustrating' and 'disheartening' for those looking to buy affordable real estate

She's calling for more affordable housing so to rebalance the state's property market

Please CLICK for the HTW Valuers National Residential Property Month In Review - February 2024

Please see below HTW Valuers National Property Clock for Houses